In the world of finance, a trader buys and sells financial instruments. Any monetary contract between two parties that we can create, trade, or modify is a financial instrument. NerdWallet has reviewed and ranked online stock brokers based on which ones are best for beginners. This list takes into consideration the stock broker’s investment selection, customer support, account fees, account minimum, trading costs and more.

Today, trading is available not only for professionals with financial education, but for retail traders who may see it as a source of additional income or an intellectual challenge. However, note that financial literacy and continued learning is essential to a trader’s success. Discount brokerage firms charge significantly lower commissions per transaction but provide little or no financial advice.

Understanding Stock Traders

Many discount brokers offer margin accounts, which let traders borrow money from the broker to buy assets. This increases the size of the positions they can take but also increases the potential loss. Many large financial institutions have trading rooms where traders are employees who buy and sell a wide range of products on behalf of the company. Each trader is given a limit as to how large of a position they can take, the position’s maximum maturity, and how much of a mark-to-market loss they can have before a position must be closed out.

- In addition to the Series 7 and 57, many states require a candidate to pass the Uniform Securities Agent State Law Examination, commonly referred to as the Series 63 exam.

- This must be deposited into the client’s account prior to any day-trading activities and maintained at all times.

- Yes, as long as the share price is below $100 and your brokerage account doesn’t have any required minimums or fees that could push the transaction higher than $100.

- The risk in scalping lies in the quick generation of successive losses rather than gains.

- Trading penny stocks is one market strategy that can be highly profitable for individuals.

- Trading stocks can bring quick gains for those who time the market correctly.

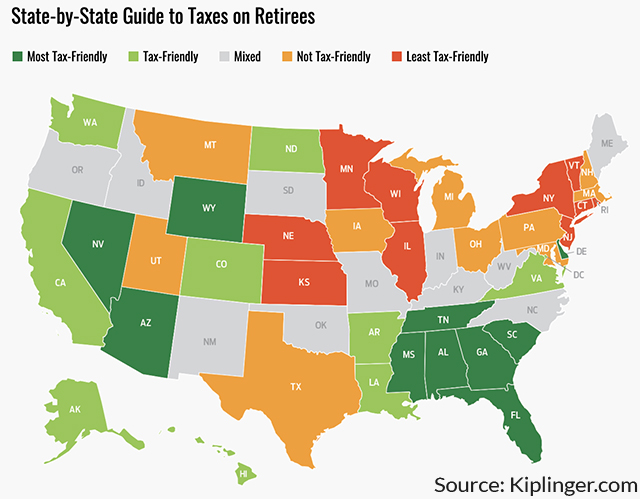

If you’ve sold stocks for profit, make sure to set aside some extra cash for a larger-than-normal tax bill. Another benefit of keeping good records is that loser investments can be used to offset other taxes through a neat strategy called tax-loss harvesting. There’s no need to cannonball into the deep end with any position. Taking your time to buy (via dollar-cost averaging or buying in thirds) helps reduce exposure to price swings. Moore says you can also look into high-dividend stocks, which pay out a portion of earnings to investors, and ETFs, which allow you to spread your risk out among multiple companies. Being a successful investor doesn’t require finding the next great breakout stock before everyone else.

Options Trader

A day trader may find a stock attractive if it moves a lot during the day. That could happen for a number of different reasons, including an earnings report, investor sentiment, or even general economic or company news. There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. A finance representative, also known as a financial advisor, provides sound financial proposals to clients. Primarily, financial advisors guide and plan the financial decisions of clients based on their needs, goals, and requirements.

NYSE’s Lynn Martin on Capital Markets, IPO Trends, and the Role AI … – Madrona Venture Group

NYSE’s Lynn Martin on Capital Markets, IPO Trends, and the Role AI ….

Posted: Wed, 13 Sep 2023 15:14:27 GMT [source]

If you’re looking to jump into the world of day trading, you can use one of the best stock brokers for day trading. While most day traders lose money, there are day traders who can make a profit. Zippia estimates that the average income of successful day traders is about $117,000 per year, or about $56 per hour. However, there are also risks—solo day traders must also trade with their own money, which comes with much greater risk than an ordinary salary. In contrast, swing traders try to anticipate the peaks and troughs of a stock’s price movements over a longer time frame, often weeks or months.

What is the difference between trading and investing?

Some of these strategies include scalping, day trading, swing trading, event trading, and position trading. It should be noted that no trading strategy is foolproof; there are advantages and disadvantages to any trading strategy. Every bank will have a different philosophy when it comes to creating sales trader roles. As the name implies, sales traders are required to wear multiple hats. In years past traders exclusively managed risk, while sales people exclusively managed client relationships. So, a client who wanted to do a trade – say an equity derivatives trade – would call up the sales person they know on the equity derivatives desk and ask for a price on the product they were looking to trade.

The profit potential of day trading is an oft-debated topic on Wall Street. Internet day-trading scams have lured amateurs by promising enormous returns in a short period of time. Day traders are typically well-educated in the minutia of trading and tend to be well funded.

Traders play an important role in the market because they provide much-needed liquidity, which helps both investors and other traders. Liquidity means there’s enough volume of trades as well as buyers and sellers in the market so that stocks can be bought or sold easily. Sole traders are people who own 100% of their business, which is not a limited company. There are many different asset types for traders, including stocks, indices, forex, commodities and more. They can be traded as derivatives, such as contracts for difference (CFDs), options and futures.

Crypto Trader Who Turned $1238 to $6 Million With PEPE, CNNC … – Analytics Insight

Crypto Trader Who Turned $1238 to $6 Million With PEPE, CNNC ….

Posted: Wed, 13 Sep 2023 07:00:42 GMT [source]

A commodity trader is one who specializes in trading commodities such as wheat, corn, livestock, oil, precious metals, and so on. Commodities traders may trade actual physical commodities in the spot market, but more often trade in commodities derivatives such as forwards, futures, and options contracts. There are many types of traders, which generally describe their trading strategies and philosophies. The following list of traders shouldn’t be considered an exhaustive one because, as noted above, traders generally use a variety of methods when they execute their trades. Money is a key one, but passion and fascination with finance and the movements of investment funds are key, too. If you like dealing with people as well, you might prefer a broker’s life.

For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market is able to take advantage of the price differential. Day traders use any of a number of strategies, including https://1investing.in/ swing trading, arbitrage, and trading news. They refine these strategies until they produce consistent profits and limit their losses. Individuals who attempt to day-trade without an understanding of market fundamentals often lose money.

The Definition of a Trader

Combined, these tools provide traders with an edge over the rest of the marketplace. This is usually reserved for traders who work for larger institutions or those who manage large amounts of money. A large amount of capital is often necessary to capitalize effectively on intraday price movements, which can be in pennies or fractions of a cent. In 1776, Adam Smith published the paper An Inquiry into the Nature and Causes of the Wealth of Nations.

A working knowledge of technical analysis and chart reading is a good start. But without a deep understanding of the market and its unique risks, charts can be deceiving. Profiting from day trading is possible, but the success rate is inherently lower because it is risky and requires considerable skill.

Capital gains represent the difference between the purchase price–called cost basis–and the sale price of the stock or security. Dividends are cash payments by companies that reward shareholders for buying their stock. Some stock investors hold onto positions for years, particularly if it’s a solid, stable company with a consistent track record of paying range bound market means dividends. Dividend income strategies are popular with retirees since it helps generate an income stream to complement Social Security income. Institutional buy-side traders have much less latitude for market trading. Buyside traders are responsible for transactions on behalf of management investment companies and other registered fund investments.

Traders make money by employing trading strategies that try to predict when a market is likely to advance or decline and then place orders accordingly to catch that move. Basically, you want to buy stocks when they are low and sell when they are high, and this difference is what a trader makes. In general, commodity brokers hold similar degree levels compared to traders.

A day trader is a type of trader who executes a relatively large volume of short and long trades to capitalize on intraday market price action. Day traders can also use leverage to amplify returns, which can also amplify losses. A day trader is commonly used to describe someone who enters and exits multiple positions in a single day. These traders never hold a position from one trading day to the next, which is why they’re called intraday traders. They tend to work with stocks, options, currencies, futures, and even cryptocurrencies. Individual traders, also called retail traders, often buy and sell securities through a brokerage or other agent.

That’s a basket of stocks whose returns closely align with one of the benchmark indexes. „Try investing in the market without putting money in the market yet to just see how it works,“ says Moore. „If all of your money’s in one stock, you could potentially lose 50% of it overnight,“ Moore says. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

Stocks, futures, options, ETFs, and mutual funds all trade differently. Without a clear understanding of a security’s characteristics and trading requirements, initiating a trading strategy can lead to failure. To handle these risks, a day trader must have a sufficient cushion of capital.

Examples of market-timing information include economic and financial releases, as well as market sentiment indicators. Generally, swing trading is considered to be less risky than scalping or day trading because swing traders have more time to make decisions. News or events can affect the price trends of the swing trader’s portfolio. So, for example, it’s not uncommon to find sales traders in areas like equity derivatives and rates trading (along with dedicated sales people and dedicated traders). A trader’s trading operations are made using their own funds (taking into account access to leverage) or using investor’s money which has been allocated for them to use.

If that level of income seems attractive, there is good news about the employment outlook for the industry, as predictions call for a healthy availability of jobs over the coming years. The BLS estimates that employment for securities, commodities, and financial services sales agents will grow 10% from 2021 to 2031, exceeding the average for all occupations. While competition for these positions may be intense given the necessary skills involved, the BLS estimates that 46,600 job openings per year in this area over the decade. Many people may be interested in working as a trader because of the possibility of earning a substantial paycheck.

Uninformed traders make decisions sometimes based on volatility and try to capitalize on it for financial gain. Stock traders (or equity traders) are people who trade in equity securities. Their primary goal is to purchase and sell shares in different companies and try to profit off short-term gains from stock price fluctuations for themselves or for their clients. A stock trader is a person who attempts to profit from the purchase and sale of securities such as stock shares. Stock traders can be professionals trading on behalf of a financial company or individuals trading on behalf of themselves. Stock traders participate in the financial markets in various ways.

The spice trade was of major economic importance and helped spur the Age of Discovery in Europe. Spices brought to Europe from the Eastern world were some of the most valuable commodities for their weight, sometimes rivaling gold. ] trace the origins of commerce to the very start of transactions in prehistoric times.

Lack of knowledge about these necessities specific to securities can lead to losses. Aspiring traders should ensure full familiarity with the trading of selected securities. In addition to the Series 7 and 57, many states require a candidate to pass the Uniform Securities Agent State Law Examination, commonly referred to as the Series 63 exam. The Series 63 exam also tests various aspects of the stock market. When an individual has a license from FINRA, they have the ability to buy or sell stocks and other securities. To be a broker, you must get 72% or higher on the General Securities Representative Examination — more commonly referred to as the Series 7 exam.

A broker often spends a great deal of time keeping clients informed of variations in stock prices. Additionally, brokers spend a fair portion of their days looking to expand their client bases. They do this by cold calling potential customers and showcasing their background and abilities, or holding public seminars on various investment topics. Trading is typically short-term and tends to involve more active management of the portfolio. Investing, on the other hand, involves buying and holding securities for the long-term. The goal of investing is typically capital appreciation and income generation over the long-term.